These days, crypto-monetary trade has been relatively flourishing. But here are some recommendations for novices and investors in cryptocurrency trading, which you should all know. It might help you maintain your position in the bitcoin market in the long term. So why do we get into the store late and learn more?

Most traders who trade massively in cryptocurrencies such as bitcoin and purchase ethernet, and such traders always win. Still, cryptocurrencies can occur once they have a sufficient understanding of trading and risk management techniques. When it comes to leverage trading, traders must revise their approach to trade cryptocurrencies. For more precise and accurate information, visit Pattern Trader

Invest before you know the Risk

Although well-versed in cryptocurrency trading, there is always a danger. You thus need to assess the proportion of risk and how much cash might have a negative effect. Furthermore, if the threat is adequately determined and you have decided to accept it favorably, such traders might be involved in this sort of transaction.

Have a Trade Purpose

You must have a motivation or purpose to trade in bitcoin. Whether it is day-trading or scalp trading, a motive is always essential to guide you. Get the concept clear that someone wins and someone loses in cryptocurrencies. Giant and very volatile whales control the bitcoin market. So all your notes are in the hands of the giant whales if you make a tiny error. Sometimes, then, we should gain nothing from some deals rather than welcome losses.

Put your Investment in Several Coins

Warren Buffet famously quoted: “Don’t put every egg in a basket,” which is entirely accurate for the bitcoin industry. You should thus invest in several cryptocurrencies and avoid investing in just one currency to avoid excessive risk.

Make a Profit and Loss Target

The easy but most challenging thing to know is when to pull out of the deal, whether we are profiting from Bitcoin or losing it. It is vital to establish a stop-loss level that may assist reduce losses, and this is one of the characteristics that all investors need. It also applies to profits. Don’t be greedy; establish a profit level too to keep things straight.

Every Deal cannot ensure a Profit

As bitcoin is more or less like other CFDs like forex and commodities, there are also loss risks, and in every transaction, nobody can assure a profit.

Stay Attentive to FOMO

Fear of failure is one of the most prevalent causes for the loss of bitcoin traders. Most people watch bitcoin trading from outside and begin to assume that they would benefit. However, this is not the actual image of bitcoin trading. Your dread of being missed might be an excellent chance for others to capture digital currency. Stay attentive in the circumstances like this.

Avoid causes of Fear and Greed

Fear and greed are two emotional variables that need modification since they are responsible for poor businesses. However, we cannot eliminate these influences.

Take a look at your Risks

Be intelligent enough not to run behind in generating huge gains, but rather stay there and collect little profits and be regularly involved in bitcoin dealing.

Trade with only one Plan

“The plan fails,” is a famous statement that has the crypto trading industry. You should apply a proper plan step by step to achieve a good outcome during cryptocurrencies trading.

Management of Risk

Looking at the crypto-monetary market, pricing for most altcoins rely on Bitcoin’s current market price. You have to observe that when the price of Bitcoin goes up, then the altcoins decrease; it’s vice versa. Most bitcoin traders may be confused. So it is preferable to have near targets or not trade during that period.

Use tools to mitigate risk TP/SL

In every platform, you may lock your risk and earnings. There is a risk mitigation mechanism. You may either wait or utilise crypto coins exclusively, but if you are trading in speculation, you must have pricing entrance and exit points in the computation. It enables you to recuperate and keep in the trading business by following this.

Go with market capacity rather than affordability.

All novices make a frequent error by buying a coin when prices are low. However, the choice to invest in a currency should be a little affordable and more market-based. It is better to pick or choose to invest with a coin’s market cap instead of utilising its price.

Follow the Established Tactics

Many tactics exist, and no technique can yield the intended result. Once the method is proven, you may plan to use it in a real trading account.

Crowd-sales

With Initial Coin Offering, companies provide the public with an early opportunity to participate in their concept on a massive scale. In return, they will obtain tokens at the lowest price to sell in exchanges at a more fantastic price. ICOs may be pretty successful in records that show certain coins over ten times the value of their anticipated returns. It is also essential to watch the team driving the project and analyse its capacity to deliver.

Altcoin Traders Comprehend the Changes

Since most Altcoins lose value after a given period, it is most important to realise that you must be attentive not to hold it for a long time when you keep a long-term altcoin. The daily volumes of trade are the most significant measures for long-term investing. The trick here is to monitor the diagrams of these currencies and take account of other price surges.

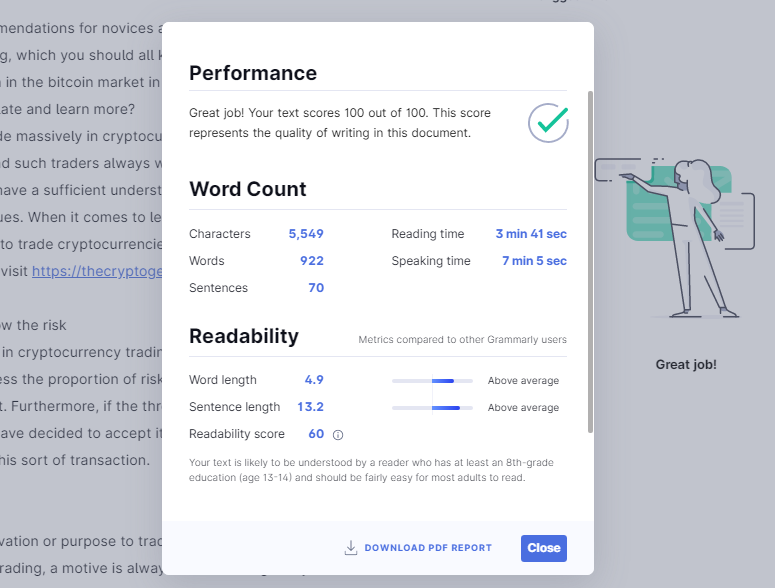

Grammarly

Plagiarism

0 Comments