The AUS/USD is one of the most popular currency pairs in the global market. It holds significant importance for investors and traders, serving as an indicator of economic relations between Australia and the United States.

AUS/USD is the sixth most widely traded pair among all major currencies. Approximately 5% of all international market transactions involve the Australian dollar. Several factors contribute to the attractiveness of AUD for financial market players.

The Australian dollar is the third-largest currency in the world and maintains strong economic ties with the United States, making it a crucial instrument for trade between the two countries. AUS/USD is known for its high liquidity, facilitating easy trading for investors.

The economic ties between Australia and the United States hold great significance for the global economy. Australia is one of the largest exporters of resources such as coal and iron ore, and the U.S. is the largest importer of these commodities. Additionally, Australia plays a significant role as a partner to the United States in matters of defense and security.

However, in Australia, the economic situation can be somewhat unstable. The country has recently faced financial problems such as rising unemployment and reduced consumer spending, potentially leading to a decline in the Australian dollar’s value.

Thus, it can be concluded that AUS/USD more often depends on fundamental indicators than technical data.

First of all, the events taking place in Australia and the USA should be considered. Significant disparities between predicted and reported indicators can result in substantial market fluctuations. Also, inflation indicators, currency interventions, interest rates, etc., are seriously evaluated.

The most exciting thing is how weather phenomena affect currency pair fluctuations. The Australian dollar exchange rate is closely linked to crop prices. Reports of potential natural disasters (hurricanes, droughts, etc.) signal a potential decrease in the value of AUD.

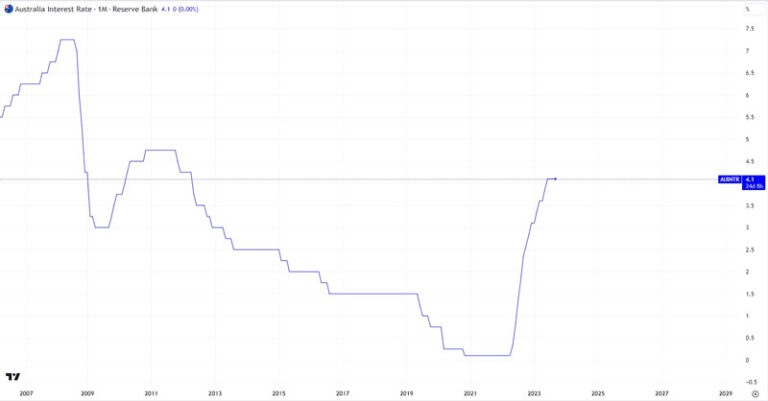

For instance, in a recent event featured prominently in the economic calendar, news regarding Australia’s current interest rate was notable. The rate remained unchanged for the third consecutive meeting following data that suggested a faster-than-expected decline in inflation.

The rate stands at an 11-year high of 4.1%, having increased by 400 basis points since May 2022. Traders expect it peaking following an unexpected drop in year-on-year inflation to 4.9% in July, which is the lowest since December last year when it reached 8.4%.

In addition, the latest employment report showed that the unemployment rate in July had risen from 3.5% in the previous month to 3.7%, reinforcing expectations that the central bank would maintain its current stance.

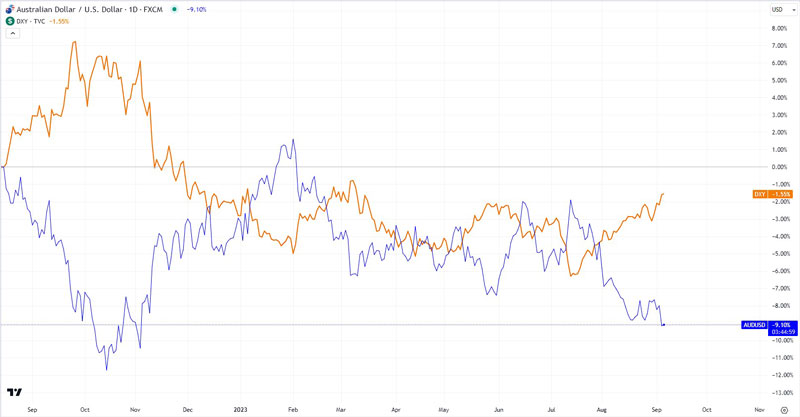

Unfortunately, such factors leave room for bears, and it is more likely that the price will continue to decline.

The stop should be expected in the area of the local minimum remaining after the previous major fall, namely at 0.6300 and 0.6200. Given the fact that the current serious support of 0.6400 has been breached, and the price has settled lower, the potential for a decline to these levels is a possibility, with potential sales considered upon the breach of 0.6350.

It is worth noting the expectations concerning the U.S. dollar currency index (DXY), which exhibits an inverse correlation with AUS/USD. The DXY continues to rise and aims to reach historical resistance around 105.600.

Given the upcoming forecasts suggesting the inflation rate in the U.S. will remain at the same place, there are concerns regarding further decline. Thus, a reversal in AUS/USD may coincide with a halt in its downward trajectory.

0 Comments