Binance is a cryptocurrency exchange that allows for the trading of major cryptocurrencies. Since its launch in 2017, Binance has been growing exponentially and is now one of the largest exchanges by volume across all platforms. In this article, we’ll go over some strategies to trade on Binance and discuss how to use their platform effectively.

Understand the Basics of Trading on Binance:

One of the most important things to understand when trading on Binance is that you do not own any cryptocurrency until your coins are in your account. Binance does not hold your tokens, and they remain at all times under the control of their respective owners. This means if anything happens to Binance, like closure or a hack, no one will be able to help recover lost funds, so it’s essential for users to follow best practices around securing access to an exchange.

Besides, it is a common practice for Binance to request ids and other personal information from users. This is done as an anti-money laundering measure, making it harder for people to take advantage of the system by using multiple accounts under different aliases. If you are confused between choosing Binance and any other site like Kraken, then make sure to compare them both. For instance, check out the kraken vs Binance review for making an informed decision.

Know how To Read Charts:

If you are new to trading, the best way to start is by learning how to read charts. Even if you don’t know anything about technical analysis (TA), it’s still possible for investors of all levels to use Binance effectively using only price charts. Binance offers a vast array of charting tools that can be used in various ways depending on what sort of information users want.

The most important thing when looking at any type or time frame chart is determining whether market conditions are trending up or down and spotting trend reversals before they happen so you can act accordingly. Knowing how long something has been going will help indicate where momentum might shift next, which could mean huge gains with little effort.

Keep Your Goals Realistic:

Trading can be very lucrative and rewarding, but it’s also a lot of work. You need to make sure you’re making enough money from your investments while putting in the right amount of time and energy into market research and trading activity. Don’t get discouraged if things don’t go as planned or take longer than expected; every successful investor has plenty of stories about trades that didn’t pan out how they wanted them to. You can make a plan that’s flexible and still allows you to meet your goals so that if things don’t go as planned, you can adjust without too much trouble.

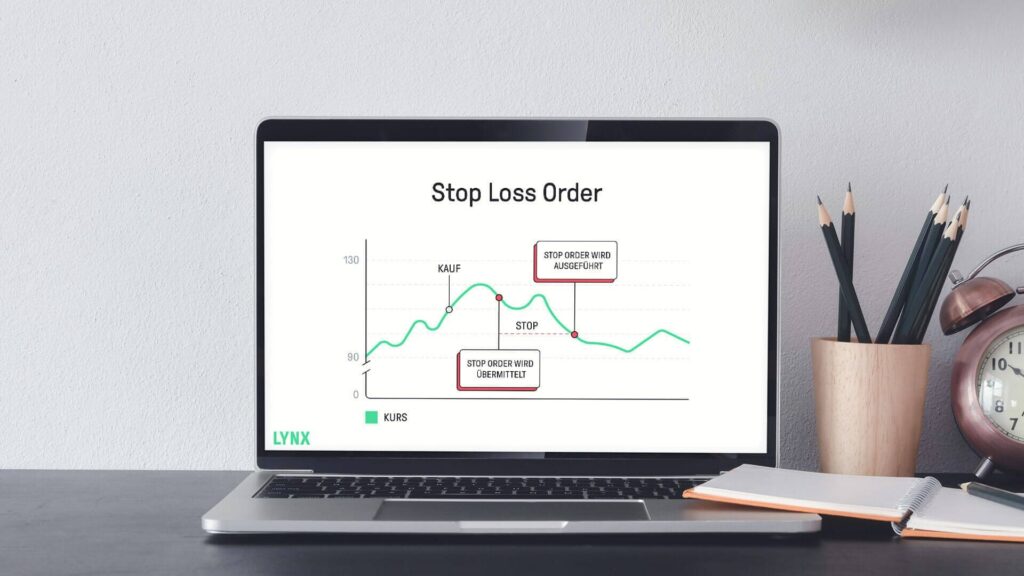

Use Stop-Loss Orders to Avoid Any Unnecessary Losses:

If you want to avoid any unnecessary losses while trading, consider using stop-loss orders. A stop-loss order is used to automatically sell an asset when the price reaches a certain value. This helps traders manage risk, especially if they are trying to get out of their position before things take an unexpected turn for the worse.

You might also want to consider using limit orders instead of market orders. When you place a buy or sell order with a limit price, this means that the order will only be executed when your desired price is reached. This can help traders set up their trades in advance, so they don’t miss any opportunities. For example, if you have a limit order to sell at $20, this means that your sell order will only be executed when the price is equal to or greater than $20.

Know the Difference Between Limit and Market Orders:

A limit order is a pending order that specifies the price at which to buy or sell a cryptocurrency. They are especially useful when paired with stop losses, which will help prevent you from getting liquidated by market movements if the price begins trending downward towards an unfavorable entry point. On the other hand, market orders allow traders to buy or sell cryptocurrencies at whatever prices are currently being offered.

Keep Your Private Key Secure at All Times:

The private key is a unique secret number that allows you to access your cryptocurrency. It’s what makes trading cryptocurrencies in an exchange possible, and it should never be shared with anyone else. The only way to buy or sell from Binance when using their web platform is by entering the correct password into the “Funds > Deposit/Withdrawal” page.

Be Careful when Using Market Orders:

Market orders are often the fastest way to buy or sell cryptocurrency on an exchange, but they can also be dangerous. When a trader uses a market order in Binance, for example, it will execute immediately at whatever price is currently being offered by other traders. This means that if you use a market order to purchase a coin, and the price suddenly shifts up or down before your trade executes, you will either end up purchasing more of that cryptocurrency than intended or less.

Conclusion:

In conclusion, Binance is a great place to buy and sell cryptocurrency. Make sure you follow the steps above for the best trading results on their platform!

0 Comments